ATM Asset Management: Strategies for Success

ATM asset management is key to boosting your business's cash flow and simplifying how you manage ATMs. Here’s a quick breakdown of why it's important:

Increase foot traffic: ATMs draw customers into stores.

Reduce credit card processing fees: Encourage cash payments.

Generate surcharge revenue: Every withdrawal earns you money.

Improve in-store spending: 60% of cash withdrawn is spent immediately on-site.

With over 35 years in the industry, ATM management systems help small businesses increase profits by providing cash access right in their stores. Investing in ATMs offers a reliable revenue stream from surcharge fees and keeps customers happy and spending more.

As Lydia Valberg, co-owner of Merchant Payment Services, I fuse tradition with innovation to offer the best in ATM asset management. Our family's commitment is to make ATM investment smooth and profitable for you.

Understanding ATM Asset Management

ATM asset management is all about efficiently overseeing your ATM network to boost profits and simplify operations. Let's explore what this means for businesses and banks.

ATM Network Management

Think of ATM network management as the backbone of your ATM operations. It involves the strategic placement, maintenance, and monitoring of ATMs to ensure they are always operational and ready to serve customers.

Here's why it's crucial:

Efficiency: Well-managed networks reduce downtime, which means more transactions and more revenue.

Customer Satisfaction: Reliable ATMs keep customers happy and coming back.

Cost Control: Regular maintenance and monitoring help prevent costly repairs.

Merchant Payment Services, a family-owned business with over 35 years of experience, emphasizes the importance of a robust ATM network. They partner with leading brands like Nautilus Hyosung and Genmega to ensure top-notch quality and reliability in their machines.

Asset Management of a Bank

For banks, managing ATM assets is about more than just machines. It's about maximizing the value of these assets while minimizing risks and costs.

Here's how banks benefit:

Optimized Cash Management: Ensuring ATMs are stocked with the right amount of cash reduces the need for frequent refills and cuts down on operational costs.

Data-Driven Decisions: Collecting and analyzing transaction data helps banks make informed decisions about where to place ATMs and how to serve customers better.

Security: Implementing advanced security systems protects both the bank and its customers from fraud and theft.

Merchant Payment Services stands out in the industry with a 5-star Google rating, highlighting their commitment to excellence and customer satisfaction. They simplify ATM ownership and management, making it accessible and profitable for businesses and banks alike.

By understanding and implementing effective ATM asset management, businesses and banks can open up the full potential of their ATM networks, driving revenue and enhancing customer experiences.

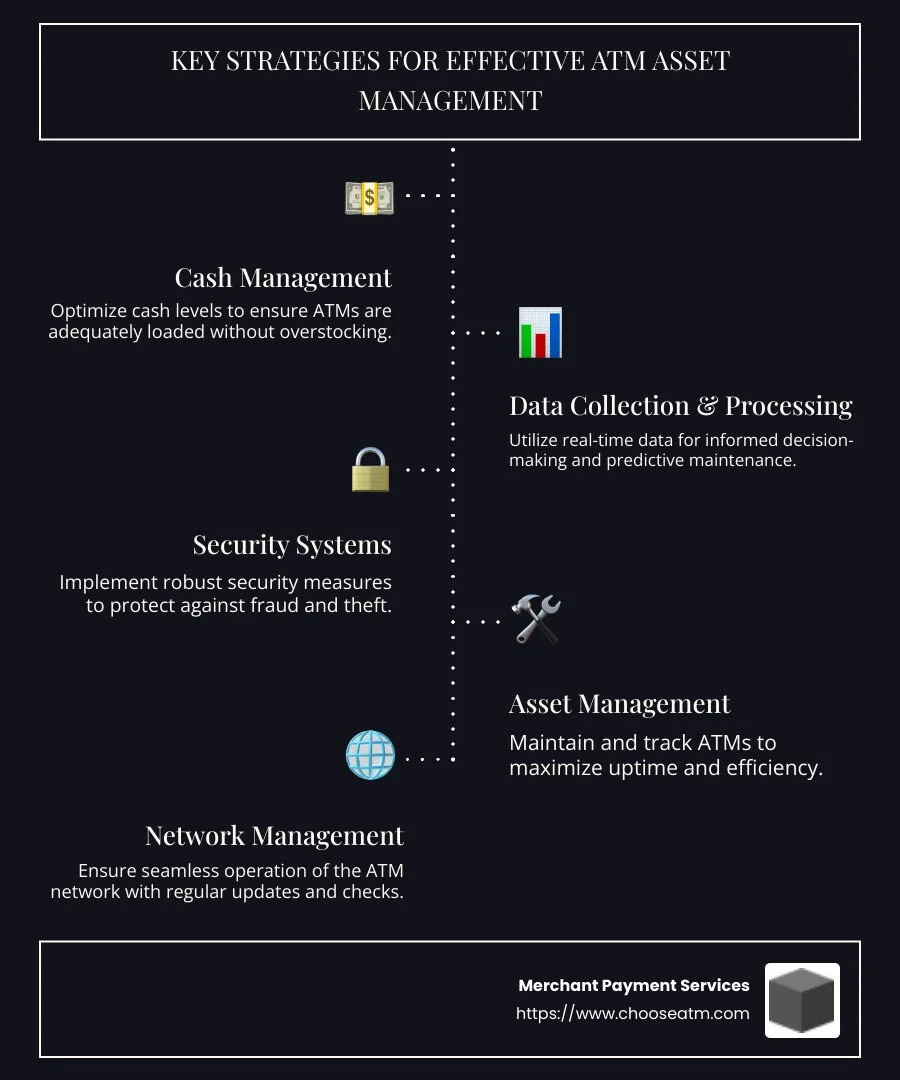

Key Strategies for Effective ATM Asset Management

To excel in ATM asset management, you need to focus on three key strategies: cash management optimization, data collection and processing, and a robust security system. Let's break these down.

Cash Management Optimization

Efficient cash management is crucial for maximizing the profitability of ATMs. Here's how to optimize it:

Predictive Cash Stocking: Use historical data to predict cash demand and avoid overstocking or understocking. This reduces the frequency of cash refills and saves on operational costs.

Dynamic Cash Levels: Adjust cash levels based on location-specific trends. For instance, ATMs in busy areas might require more frequent stocking.

Merchant Payment Services emphasizes the importance of cash management, helping businesses keep their ATMs profitable and operational with minimal downtime.

Data Collection and Processing

Data is a powerful tool in ATM management. Here's why:

Transaction Analysis: By analyzing transaction data, businesses can identify peak usage times and adjust strategies accordingly. This helps in optimizing cash levels and improving customer service.

Performance Monitoring: Regularly tracking ATM performance helps in identifying issues before they become problems, ensuring high uptime and reliability.

Merchant Payment Services uses data-driven insights to help businesses make informed decisions, ensuring their ATMs are always ready to serve customers.

Security System

Security is a top priority in ATM management. Here's how to improve it:

Advanced Surveillance: Implementing cameras and monitoring systems deters theft and fraud, protecting both the business and its customers.

Secure Transactions: Use encryption and secure communication channels to protect sensitive customer information during transactions.

Merchant Payment Services partners with leading brands to provide ATMs equipped with state-of-the-art security features, ensuring peace of mind for both businesses and customers.

By focusing on these strategies, businesses can improve their ATM asset management efforts, leading to increased efficiency, profitability, and customer satisfaction.

The Role of Due Diligence in ATM Investments

When investing in ATMs, due diligence is essential. It's like doing your homework before a big test. This process helps you make smart decisions and avoid potential pitfalls.

Ponzi Schemes

One major risk in ATM investments is falling victim to Ponzi schemes. These are scams where returns are paid to earlier investors using the capital from new investors, rather than from profit earned. It’s important to be aware of these schemes because they can lead to significant financial loss.

Jeremy Roll's Insights

Jeremy Roll, a respected investor, often emphasizes the importance of thorough due diligence. He advises investors to dig deep into the details of any investment opportunity. By understanding the ins and outs, you can protect yourself from scams and make informed decisions.

Due Diligence Workflow

A robust due diligence workflow involves several steps:

Research the Company: Look into the company’s history, reputation, and financial stability. Check for any red flags or past issues.

Analyze Financials: Review the company's financial statements. Ensure they are transparent and consistent.

Check Legal Compliance: Verify that the company complies with all legal requirements and industry standards. This includes checking for any past legal issues.

Evaluate Market Position: Understand the company's position in the ATM market. Are they leaders or just starting out?

Consult Experts: Get opinions from financial advisors or experts in the field. They can provide valuable insights and help identify potential risks.

By following a structured due diligence workflow, investors can minimize risks and maximize their chances of success in ATM investments. This careful approach ensures that you are not just investing blindly but making informed choices that align with your financial goals.

Understanding these aspects of due diligence can greatly contribute to a successful ATM investment strategy.

Advantages and Disadvantages of ATM Offerings

When considering ATM investments, it's important to weigh the advantages and disadvantages of ATM offerings. These offerings can be a great way to raise capital, but they come with their own set of challenges.

At-the-Market Offering

An at-the-market (ATM) offering allows companies to raise capital by selling shares directly into the market at prevailing prices. This method is flexible and can be done at any time, providing businesses with the ability to quickly access funds as needed.

Advantages:

Flexibility: Companies can choose the timing and amount of shares to sell based on market conditions.

Cost-Effective: It often has lower fees compared to traditional public offerings.

Market Pricing: Shares are sold at market prices, which can be advantageous if the company's stock is performing well.

Disadvantages:

Market Impact: Continuous selling can put downward pressure on the stock price.

Dilution: Issuing new shares can dilute existing shareholders' equity if not managed carefully.

Capital Raising

Raising capital through ATM offerings can be a smart strategy for businesses looking to expand their ATM networks or invest in new technologies. It provides the necessary funds to support growth and innovation.

Advantages:

Immediate Funds: Companies can quickly raise funds to capitalize on new opportunities.

No Fixed Amount: Unlike traditional offerings, there is no obligation to raise a specific amount, providing more control.

Disadvantages:

Investor Perception: Frequent ATM offerings might signal financial instability to investors.

Regulatory Requirements: Companies must comply with regulatory requirements, which can be time-consuming and costly.

Role of Broker-Dealer

A broker-dealer plays a crucial role in ATM offerings. They help facilitate the sale of shares and ensure compliance with regulations. Their expertise is vital for navigating the complexities of the market.

Advantages:

Expert Guidance: Broker-dealers provide valuable insights and advice on market conditions.

Regulatory Compliance: They ensure that all legal and regulatory requirements are met, reducing the risk of penalties.

Disadvantages:

Fees and Commissions: Engaging a broker-dealer involves paying fees, which can add to the cost of raising capital.

Dependence: Companies may become reliant on broker-dealers for market access and advice.

Understanding these factors is essential for making informed decisions about ATM offerings. By carefully considering the advantages and disadvantages, businesses can effectively manage their ATM investments and capitalize on market opportunities.

Frequently Asked Questions about ATM Asset Management

What is ATM Asset Management?

ATM asset management involves overseeing and optimizing a network of ATMs to ensure they are profitable and efficient. This process includes managing cash levels, maintaining machines, and ensuring security. Merchant Payment Services excels in this area, with over 35 years of experience and a 5-star rating on Google, making them a trusted partner in ATM management. Their comprehensive approach ensures that ATMs not only function well but also contribute to increased sales and reduced credit card processing fees for businesses.

How Does ATM Investment Work?

ATM investment can be a lucrative opportunity for those looking to earn passive profits. When you invest in an ATM, you earn money from the surcharge fee charged to customers who withdraw cash. Interestingly, over 60% of cash withdrawn from an ATM is spent at the same location, which can boost the business's sales where the ATM is installed. With the right management, ATMs can pay for themselves through these transaction fees, making them a smart investment for businesses looking to increase their cash flow.

What Are the Risks Involved in ATM Investments?

While ATM investments can be profitable, they are not without risks. One significant concern is legal uncertainties. Investors need to be aware of the regulations governing ATM operations to avoid fines or penalties. Additionally, there have been instances of Ponzi schemes in the ATM investment world, where unscrupulous operators promise high returns but fail to deliver. It's crucial for investors to conduct thorough due diligence and partner with reputable companies like Merchant Payment Services to mitigate these risks.

By understanding these aspects of ATM asset management and investment, businesses and individuals can make informed decisions and maximize their returns.

Conclusion

In summary, ATM asset management is a vital component for businesses aiming to improve their cash flow and streamline operations. At Merchant Payment Services, we specialize in simplifying ATM ownership and management, making it accessible and profitable for businesses of all sizes. With over 35 years of experience, our family-owned business has consistently delivered excellence in ATM management, earning us a 5-star rating on Google.

Our approach to ATM management is designed to maximize your profits. We offer access to top ATM brands like Nautilus Hyosung and Genmega, which are known for their reliability and efficiency. By strategically placing ATMs in high-traffic areas, we help businesses increase foot traffic and sales. Additionally, our ATM solutions are structured to reduce credit card processing fees, further boosting your bottom line.

One of the key advantages of partnering with us is the potential for surcharge revenue. Every time a customer withdraws cash from your ATM, you earn a fee. With over 60% of cash withdrawn being spent at the same location, this not only generates revenue but also encourages more sales in your business. Our ATMs essentially pay for themselves through these transaction fees.

At Merchant Payment Services, we understand that managing an ATM network can be complex. That's why we focus on simplifying the process for you. From cash management optimization to ensuring robust security systems, we handle the intricacies so you can focus on what you do best—running your business.

To learn more about how we can help you maximize your cash flow and simplify ATM ownership, visit our service page.

Choose Merchant Payment Services for a seamless and profitable ATM management experience.