ATMs in Small Businesses: A Win-Win Situation

Exploring ATMs for Small Businesses? Here's what you need to know:

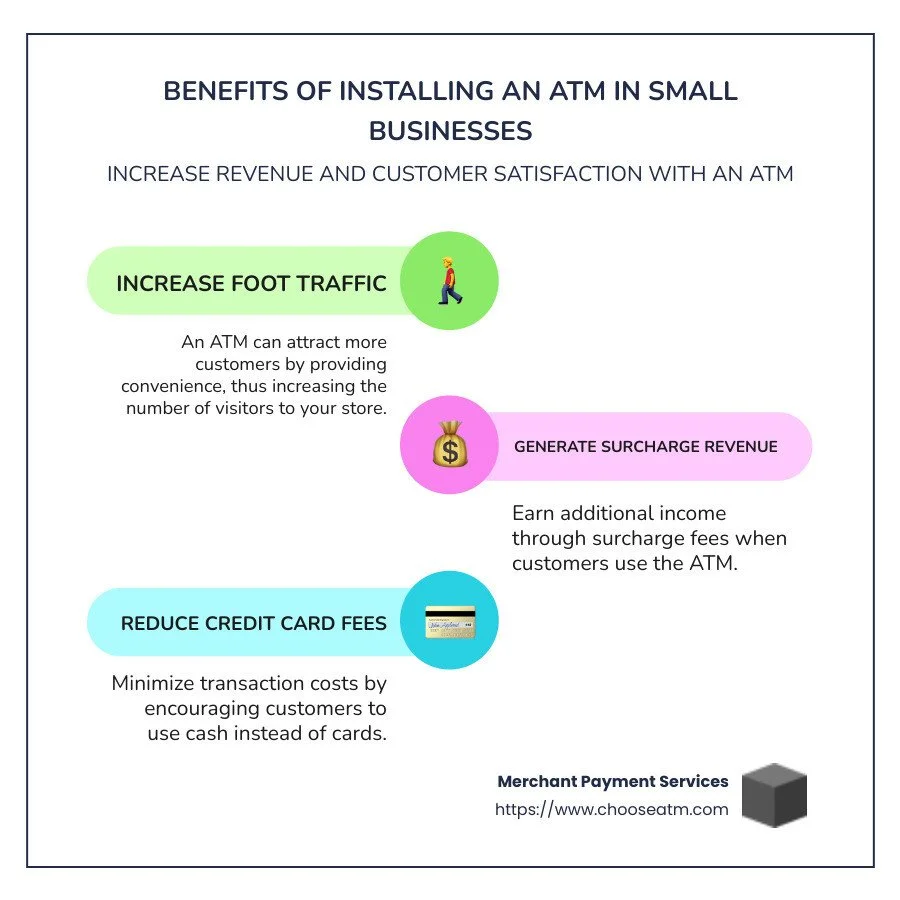

Increase Revenue: ATMs can generate surcharge fees and encourage in-store purchases.

Draw More Customers: Convenience attracts more foot traffic.

Reduce Fees: Fewer card transactions can lead to lower processing fees.

For small businesses today, installing an ATM is more than just a convenience—it's a strategic investment. An ATM not only meets customer needs by providing easy access to cash but also enhances growth potential by increasing foot traffic. This beneficial scenario results in direct financial gains such as surcharge revenue and indirectly reduces costs by minimizing credit card transaction reliance.

As Lydia Valberg, I have dedicated over 35 years to empowering small businesses with effective payment solutions. My expertise in ATMs for small businesses ensures that businesses like yours can thrive through strategic ATM management.

How to Get an ATM for Small Business

Adding an ATM for small business is a strategic investment. Here's a step-by-step guide to getting started:

Market Research

Before diving into ATM ownership, conduct thorough market research. Understand your customer base and their payment preferences. Are they frequently asking for cash back? Do they prefer cash transactions? Knowing these answers helps determine if an ATM is a good fit.

Determine Your Needs

Identify why you want an ATM. Is it to increase foot traffic, provide customer convenience, or reduce credit card fees? Each reason will influence the type of ATM and services you choose. For example, if your goal is to boost sales, an ATM with on-screen advertising might be beneficial.

Location Suitability

Assess if your business location is suitable for an ATM. High foot traffic areas like busy convenience stores or large hotels are ideal. Ensure there is a secure spot with power and internet access. The location should also comply with ADA requirements, offering sufficient space for accessibility.

Legal Requirements

Familiarize yourself with the legal requirements for ATM ownership. This includes understanding federal regulations, securing an ATM processing agreement, and preparing necessary documents like your business license and IRS W-9. Compliance is crucial to avoid legal complications.

ATM Procurement Options

Explore different procurement options:

Ownership: Purchase the ATM outright. This option allows you to earn up to 100% of the surcharge revenue but requires handling all maintenance and cash loading.

Placement Program: Partner with a provider who supplies the ATM and manages it. You share surcharge revenue but have minimal responsibilities.

Turnkey Solutions: For high-volume locations, companies can provide, load, and maintain the ATM. This is cost-effective and requires the least effort from you.

Selecting the Right ATM

Choose an ATM that fits your business needs. Options vary in style, size, and functionality. Consider whether you need basic cash dispensing or a full-service machine that handles deposits and transfers. A newer model might attract more users, increasing transactions.

By following these steps, you can seamlessly integrate an ATM into your business. This not only improves customer convenience but also opens up new revenue streams, making it a win-win for your small business.

Financial Benefits of Owning an ATM

Owning an ATM for small business can be a game-changer for your bottom line. Here's how:

Surcharge Revenue

Every time a customer uses your ATM, they pay a surcharge fee. This fee is typically between $2 and $3. While you might not keep the entire fee if you partner with an ATM provider, a significant portion goes directly into your pocket. This can add up quickly, especially in high-traffic locations. For example, in busy convenience stores or bars, up to 80% of cash withdrawn is often spent right there. This means more transactions and more surcharge revenue for you.

Reduced Credit Card Fees

Accepting credit cards can be costly due to processing fees. By encouraging cash transactions through your ATM, you can reduce these fees. When customers withdraw cash and use it for purchases, you save on the percentage cut that credit card companies take. Over time, these savings contribute positively to your bottom line.

Increased Sales

Having an ATM on-site can boost sales. Customers are more likely to spend cash withdrawn from the ATM in your store. In fact, studies show that over 60% of cash taken out is spent on-site. This not only increases your sales but also improves cash flow, as cash transactions are immediate and don't involve waiting for card payments to process.

By leveraging these financial benefits, an ATM becomes more than just a convenience for your customers; it becomes a strategic asset for your business.

Frequently Asked Questions about ATMs for Small Business

Can I buy an ATM machine for my business?

Yes, you can buy an ATM machine for your business. Purchasing an ATM for small business offers you complete control over the machine. This means you can earn up to 100% of the surcharge fees, which are the fees customers pay when they withdraw cash. These fees typically range from $2 to $3 per transaction. By owning the ATM, you can potentially maximize your income from these fees.

How do ATM owners make money?

ATM owners make money primarily through surcharge fees. Each time someone uses the ATM, they pay a fee, and a portion of this fee goes to the ATM owner. The exact amount you keep depends on your arrangement with any service providers involved, such as those who maintain or fill the ATM. In addition, ATM owners may receive daily payments from the surcharge revenue, which can provide a steady stream of income.

Should I put an ATM in my business?

Deciding to place an ATM in your business can be beneficial in several ways. First, it provides cash access for your customers, making it easier for them to make purchases. This can lead to increased sales, as customers often spend a portion of the cash they withdraw in-store. Furthermore, having an ATM can help you earn extra commission from the surcharge fees, adding another revenue stream to your business. It's a win-win situation: customers get the cash they need, and you gain financially from the transactions.

Conclusion

Incorporating an ATM for small business is more than just a financial decision; it's a strategic move towards enhancing customer satisfaction and boosting your bottom line. At Merchant Payment Services, we understand the importance of simplicity in business operations. That's why our ATM management solutions are designed to make ownership and operation as seamless as possible.

With over 35 years of experience, we offer a straightforward approach to ATM management, allowing you to focus on what you do best—running your business. Our services not only reduce the complexity of managing an ATM but also maximize your cash flow and sales. By partnering with us, you gain access to top ATM brands and benefit from reduced credit card processing fees, which further improves your profit margins.

Our unique selling proposition is clear: simplified ATM ownership. We handle the intricacies, so you don't have to. This means more time for you to focus on providing exceptional service to your customers while enjoying the financial benefits that come with having an ATM on-site.

If you're ready to explore the advantages of having an ATM in your business, learn more about our services and see how we can help you streamline operations and boost profits.