ATM Lifecycle Management: Ensuring Longevity and Efficiency

ATM lifecycle management is the vital process that oversees each phase of an ATM’s life—from its initial procurement and installation to its eventual decommissioning and disposal. This management ensures operational efficiency, maximizes investments, secures data, and promotes environmental sustainability. Here's a quick look into why ATM lifecycle management is crucial:

Maximize Investment: Regular maintenance and timely upgrades keep ATMs running efficiently, reducing costly downtimes.

Improve Security: Protect sensitive data with up-to-date security systems, encryption, and proper disposal of old data.

Environmental Responsibility: Eco-friendly disposal reduces electronic waste, aligning with sustainability goals.

The journey of an ATM is more fascinating than you might think. With the rise of modern banking, ATMs have evolved from simple cash dispensers to integral components of financial transactions worldwide. Today, automatic teller machines not only dispense cash but also facilitate complex transactions, contributing significantly to the digital banking revolution.

As a small business owner, leveraging the power of ATMs to increase foot traffic and boost profits can be an excellent strategy. Customers often spend a portion of the cash withdrawn right in-store, offering immediate revenue opportunities through surcharge fees.

I’m Lydia Valberg. With over 35 years of dedication to excellence in ATM lifecycle management, I've focused on creating trustworthy partnerships and simplifying ATM operations for businesses. My goal is to offer support that improves profits and ensures smooth transactions.

Understanding ATM Lifecycle Management

ATM lifecycle management is more than just keeping machines operational. It involves a comprehensive approach that ensures each ATM is efficient, secure, and environmentally friendly throughout its life.

The ATM Lifecycle

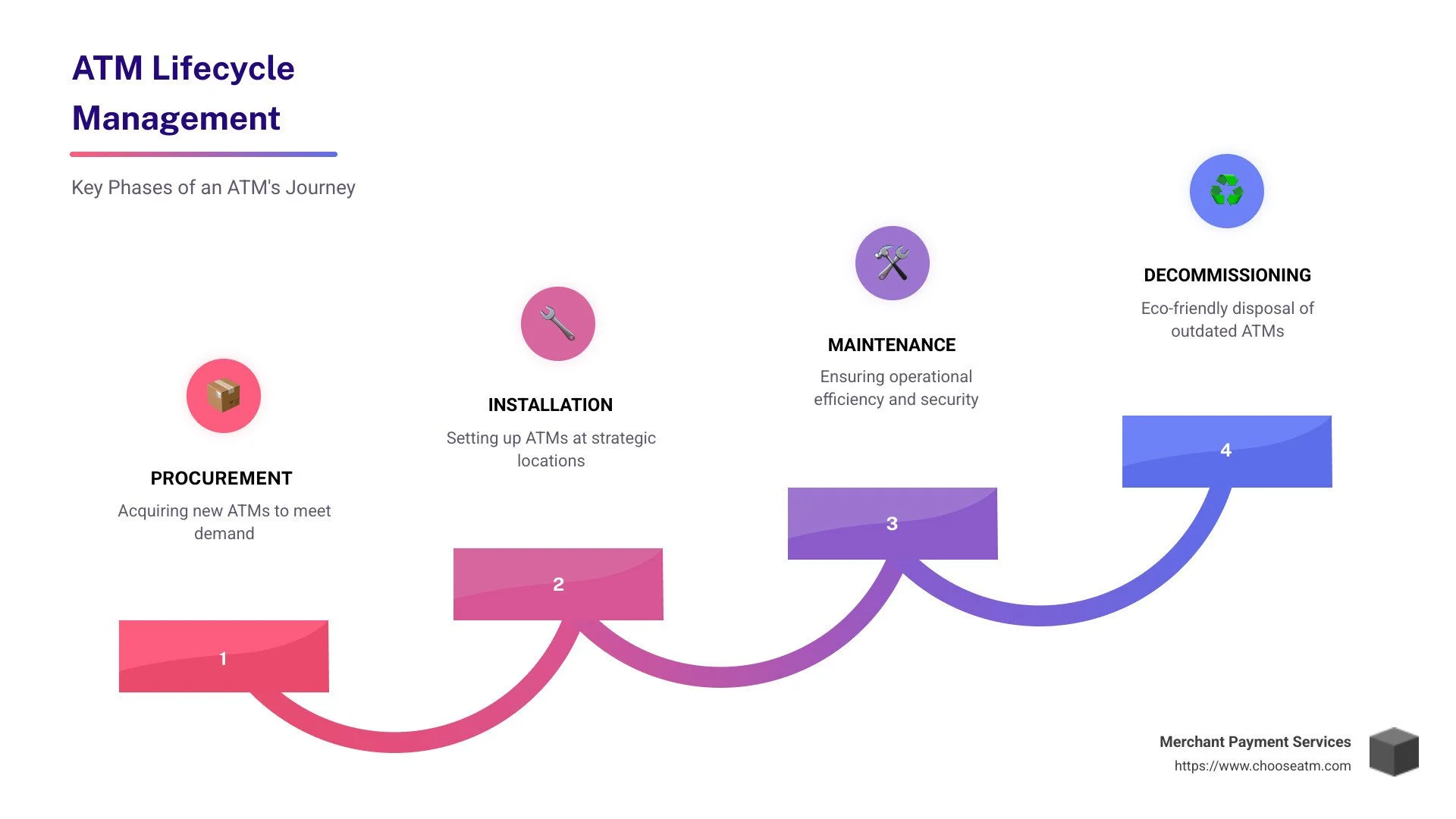

The lifecycle of an ATM includes several stages:

Procurement: Choosing the right ATM based on the bank's needs and customer demands.

Installation: Setting up ATMs in optimal locations with considerations for security and accessibility.

Maintenance and Upgrades: Regularly servicing ATMs to ensure they run smoothly and are up-to-date with the latest technology.

Monitoring and Management: Continuously checking for performance and security issues to minimize downtime.

Decommissioning and Disposal: Responsibly retiring ATMs to reduce e-waste.

Comprehensive Approach

A successful ATM lifecycle management strategy integrates data collection and a robust security system.

Data Collection: Proper data management is vital. Keeping track of transaction data securely helps in planning maintenance schedules and understanding usage patterns. This data-driven approach allows for predictive maintenance, reducing unexpected breakdowns.

Security System: ATMs are prime targets for fraud. Implementing strong security measures, such as encryption and anti-skimming technologies, is crucial. Regular security updates protect customer data and prevent unauthorized access.

The Importance of Data and Security

Data and security are the backbone of ATM lifecycle management. By collecting and analyzing data, banks can optimize ATM locations, predict cash needs, and schedule timely maintenance. This proactive management not only keeps ATMs running smoothly but also improves customer satisfaction by minimizing downtime.

Security, on the other hand, is non-negotiable. With the rise of cyber threats, safeguarding sensitive information is more critical than ever. A robust security system ensures that customer trust is maintained, and compliance with regulations is met.

In summary, ATM lifecycle management is a strategic process that goes beyond simple maintenance. It combines data-driven insights and strong security measures to ensure ATMs remain reliable and efficient. This approach not only maximizes the return on investment but also aligns with the growing demand for sustainable and secure banking solutions.

Setting Up and Maintaining ATMs

Setting up and maintaining ATMs is a critical part of ATM lifecycle management. It involves selecting locations, ensuring security, managing inventory, and replenishing cash. Each step is essential for providing a seamless user experience and maintaining operational efficiency.

Optimal Locations

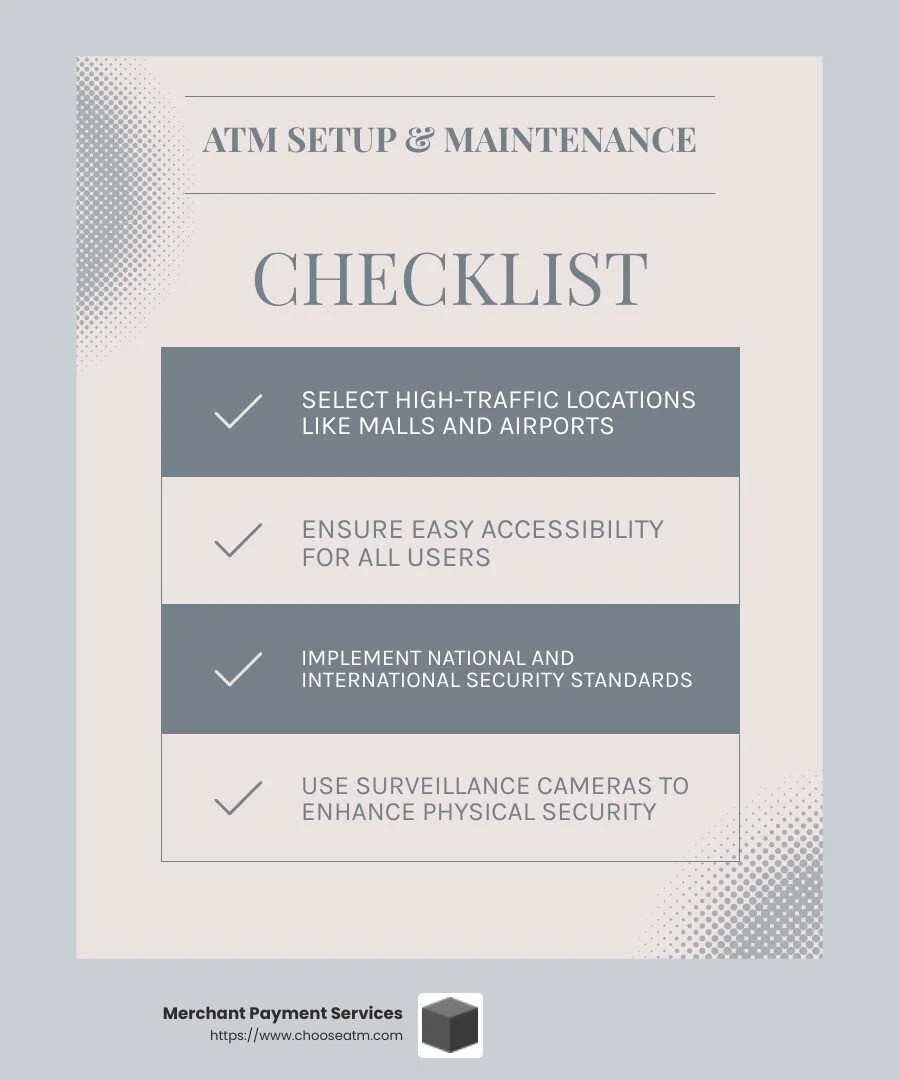

Choosing the right location for an ATM can make or break its success. High-traffic areas, like shopping malls, airports, and train stations, are prime spots. These locations see a lot of foot traffic, increasing the likelihood of ATM use.

Accessibility is key. ATMs should be easily accessible to all, including those with disabilities. Placing ATMs near bank branches can also offer added convenience to customers.

Security Standards

Security is paramount when setting up ATMs. Machines must comply with national and international security standards. This includes using secure software to prevent hacking and installing surveillance cameras for physical security.

Banks must adhere to guidelines set by financial authorities. Regular audits and updates to security systems are necessary to ensure compliance and protect customer data.

Inventory Management

Efficient inventory management is essential for keeping ATMs operational. This involves tracking cash levels to avoid shortages, especially during peak hours. Automated systems can alert banks when cash levels are low, ensuring timely replenishment.

Regular maintenance checks are also crucial. These checks ensure that hardware functions properly and that software is up-to-date. Proper inventory management minimizes downtime and improves the user experience.

Cash Replenishment

Cash replenishment is a vital task that requires meticulous planning. Banks typically have dedicated teams to handle this, often refilling ATMs during off-peak hours to minimize inconvenience.

Secure transport vehicles, such as armored trucks, are used to protect cash during transit. Timely replenishment ensures customers always find cash available, maintaining trust and satisfaction.

In summary, setting up and maintaining ATMs involves strategic planning and execution. By choosing optimal locations, adhering to security standards, managing inventory efficiently, and ensuring timely cash replenishment, banks can improve customer experience and maximize ATM efficiency.

Routine Care and Maintenance

Routine care is the backbone of ATM lifecycle management. It ensures that machines run smoothly, securely, and efficiently, providing a seamless experience for users. Let's explore the key elements of routine care:

Regular Cleaning

Keeping ATMs clean is more than just about aesthetics. A clean ATM is a reliable ATM. Dust and grime can cause buttons to stick and screens to become unreadable. Regular cleaning helps prevent these issues, ensuring that the machine functions properly.

Technicians should clean screens and keypads frequently. This not only keeps the machine looking good but also prevents wear and tear. Plus, in today's health-conscious world, a clean ATM is a must for customer satisfaction.

Inspection Needs

Routine inspections are essential for detecting potential problems before they become major issues. Inspect the ATM for signs of tampering. Thieves often target ATMs to install skimming devices. Regular inspections help spot these devices early.

Technicians should check all parts of the ATM to ensure they're functioning correctly. This includes the card reader, screen, and cash dispenser. Quick fixes can prevent downtime and keep customers happy.

Security Updates

Security is a top priority for ATMs. Regular software updates are crucial to protect against fraud and hacking attempts. These updates often include security patches that address vulnerabilities.

Changing passwords regularly and implementing strong access controls are also important. By keeping security protocols up-to-date, banks can protect customer data and maintain trust.

Receipt Paper Monitoring

Running out of receipt paper might seem like a small issue, but it can frustrate customers. Monitor receipt paper supplies regularly and replace the paper before it runs out. This simple step ensures that customers always receive a receipt, which is important for their records.

Routine care and maintenance are vital for keeping ATMs operational and secure. By focusing on regular cleaning, inspections, security updates, and receipt paper monitoring, banks can ensure their ATMs remain reliable and efficient.

Upgrading ATM Technology

Upgrading ATM technology is a crucial part of ATM lifecycle management. It ensures that machines stay secure, efficient, and user-friendly. Let’s explore the key areas for upgrades:

Software Updates

Software updates are like vitamins for your ATM. They keep it healthy and secure. Regular updates fix bugs, improve security, and sometimes add new features. These updates are critical because they protect against fraud and hacking attempts.

Security patches are especially important. They address vulnerabilities that could be exploited by cybercriminals. By keeping software up-to-date, banks can ensure customer data stays safe.

Hardware Components

Upgrading hardware components is another way to extend the life of an ATM. Older parts can be replaced with newer, more efficient ones. For example, swapping outdated card readers with EMV chip readers can improve security and speed up transactions.

Newer components also tend to last longer and reduce maintenance costs. This means fewer breakdowns and happier customers.

Touchless Transactions

Touchless transaction technology is gaining popularity, especially after COVID-19. It allows users to complete transactions without physically touching the machine. This can be done using mobile wallets or QR codes.

Touchless options are fast and convenient. They also reduce wear and tear on physical buttons, which can save on maintenance costs in the long run.

Competitive Edge

Staying competitive in the ATM market means adopting new technologies early. Customers prefer ATMs with modern features, like contactless payments. Banks that upgrade their machines not only attract more customers but also build trust by showing they care about safety and convenience.

Incorporating these upgrades into your ATM lifecycle management strategy ensures that your machines remain relevant and efficient. Up next, let's look at refurbishing and recycling ATMs to maximize their lifespan and environmental impact.

Refurbishing and Recycling ATMs

Refurbishing and recycling are key parts of ATM lifecycle management. They help extend the life of ATMs and reduce environmental impact. Let's break down the process:

Reconditioned Parts

Using reconditioned parts is a cost-effective way to refurbish ATMs. Technicians replace worn-out components like keypads and card readers with reconditioned ones. This not only improves performance but also extends the machine's lifespan.

Reconditioned parts are a win-win. They offer the reliability of new parts without the high cost. Plus, they help reduce waste by recycling usable components. Banks favor this approach to save money and maintain quality service.

Aesthetic Updates

Aesthetic updates keep ATMs looking fresh and modern. Over time, the exterior can become worn or outdated. Refurbishing includes repainting or replacing panels and screens.

A well-maintained appearance boosts user confidence in the machine's reliability. It also ensures the ATM aligns with a bank's branding. This is more than just looks—it's about user trust and experience.

Thorough Testing

After refurbishing, thorough testing is crucial. Every updated machine must meet operational standards before going back into service. Testing involves checking software updates, hardware functionality, and security features.

Technicians address any issues found during testing immediately. This guarantees that refurbished units perform as expected in real-world conditions. It's like a final quality check to ensure everything runs smoothly.

Environmentally Responsible Practices

Recycling ATMs is essential for reducing environmental impact. Banks can dispose of old machines through certified e-waste recyclers. These recyclers follow strict environmental guidelines, ensuring responsible disposal.

This practice not only protects the planet but also aligns with sustainable business goals. By refurbishing and recycling, banks contribute to a greener future while managing their ATM fleet efficiently.

Refurbishing and recycling are vital steps in ATM lifecycle management. They maximize the lifespan of machines and promote sustainability. Next, we'll dive into some frequently asked questions about ATM lifecycle management.

Frequently Asked Questions about ATM Lifecycle Management

What is an ATM management system?

An ATM management system is like the brain behind ATM operations. It handles ATM monitoring, control, and data transmission. This system keeps an eye on each ATM, ensuring it works smoothly and securely.

Monitoring involves tracking machine performance and detecting any issues, like low cash levels or technical glitches. Control allows banks to manage ATM settings remotely, making updates or changes as needed. Data transmission ensures that all transactions and updates are communicated safely and efficiently between the ATM and the bank's central system.

In short, an ATM management system is essential for keeping ATMs running efficiently and securely.

How often should you upgrade ATM technology?

Upgrading ATM technology is crucial for maintaining security and user satisfaction. Banks should consider upgrading every few years to stay ahead of security threats and provide a seamless user experience.

Security features like encryption and anti-skimming technologies need regular updates to fend off fraudsters. User interfaces should also be refreshed to meet modern standards, ensuring customers find ATMs easy and intuitive to use.

Think of it like upgrading your smartphone. New features and security patches keep it running smoothly and safely. Similarly, upgrading ATMs ensures they remain reliable and secure for users.

Why is lifecycle management important for ATMs?

ATM lifecycle management is key to efficiency and cost-effectiveness. By overseeing every stage of an ATM's life—from setup to disposal—banks can maximize their investment.

Efficiency is achieved through regular maintenance and timely upgrades. This minimizes downtime and keeps machines ready for customer use. Cost-effectiveness comes from strategic planning and refurbishing practices, which extend the life of each ATM.

Lifecycle management ensures ATMs deliver consistent service while managing costs and resources wisely.

Next, let's look at how Merchant Payment Services can help maximize cash flow and simplify ATM ownership.

Conclusion

Merchant Payment Services is here to transform how you manage your ATMs. With over 35 years of experience, we specialize in maximizing cash flow and simplifying ATM ownership for businesses. Our goal is to ensure that your ATMs are not just machines but valuable assets that improve your bottom line.

Maximizing Cash Flow

Our ATM management solutions are designed to boost your profits. Did you know that over 60% of cash withdrawn from an ATM is often spent right there on the premises? This means our ATMs can significantly increase foot traffic and sales in your business location. Plus, they pay for themselves with transaction fees, adding a consistent revenue stream.

Simplifying ATM Ownership

Owning and managing ATMs doesn’t have to be complicated. We simplify the process by taking care of everything from installation to ongoing maintenance. Our access to leading ATM brands ensures that you get the best equipment, while our expertise helps reduce credit card processing fees, further enhancing your profits.

With Merchant Payment Services, you can focus on your core business activities while we handle the intricacies of ATM lifecycle management. We provide unparalleled support, ensuring your ATMs are always up and running efficiently.

Ready to revolutionize your ATM management? Connect with us today and find how we can help you maximize your cash flow and simplify ATM ownership.

Your ATM success story starts here!