Location, Location, Location: Mastering ATM Placement

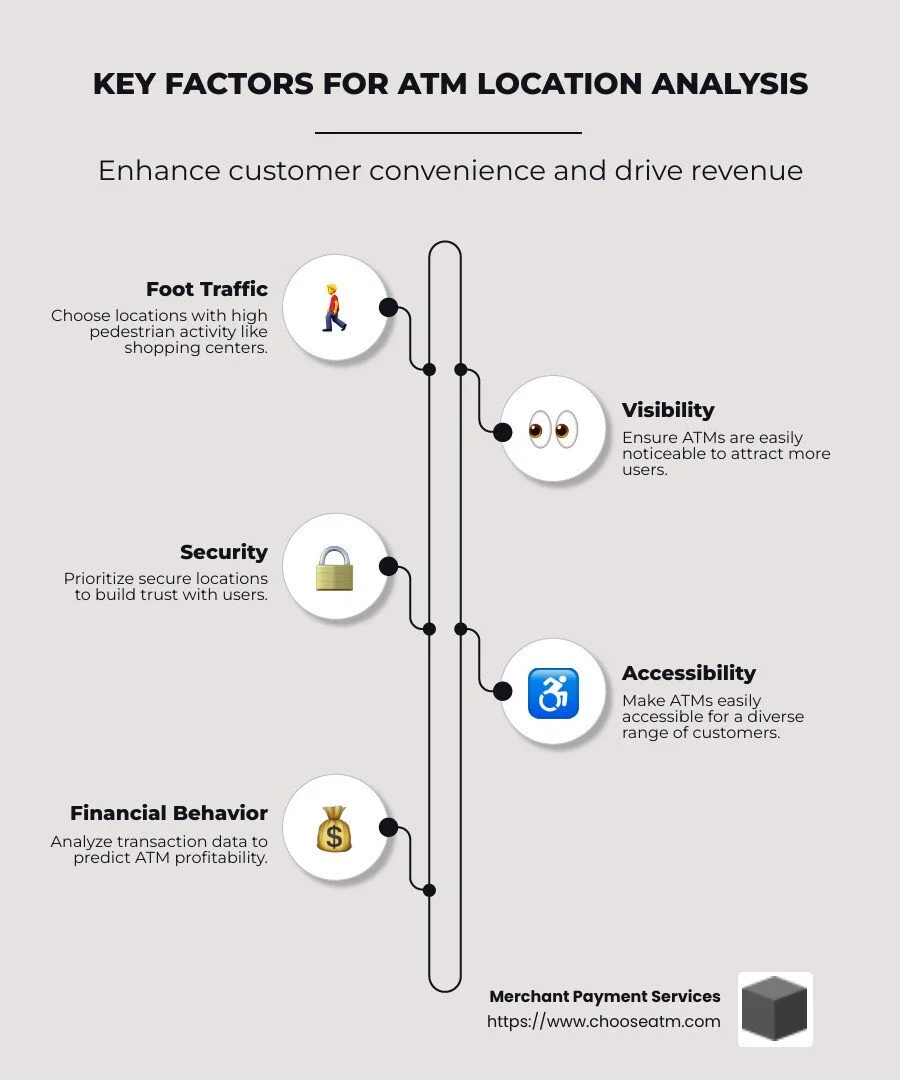

ATM location analysis is a critical process that can greatly impact your business's success. By identifying optimal locations for ATM placements, you can increase foot traffic, improve convenience for customers, and drive additional revenue through surcharge fees. Here’s a quick look at key factors to consider:

Foot Traffic: Select locations with high pedestrian activity such as shopping centers or busy streets to ensure frequent use.

Visibility: Ensure your ATMs are easily noticeable to attract more users.

Security: Prioritize safe locations to build trust and encourage more users.

Accessibility: Make sure your ATMs are easy to reach for a diverse range of customers.

Successful ATM placement hinges on striking a balance between these elements, making it a strategic move for savvy business owners aiming for growth.

I'm Lydia Valberg, bringing over 35 years of industry experience in ATM location analysis with Merchant Payment Services. My journey focuses on leveraging location intelligence and ensuring optimal ATM placement to help businesses maximize their profits.

Understanding ATM Location Analysis

ATM location analysis is a strategic process that goes beyond simply placing a machine at a random spot. It involves a thorough examination of various data points to ensure that the location will be both profitable and convenient for users.

Transaction Data

Transaction data is invaluable for understanding ATM usage patterns. By analyzing this data, you can identify when and where people are withdrawing cash, helping you to detect trends and predict future usage. This information is essential for deciding where to place new ATMs or whether to maintain existing ones in their current locations.

For instance, if the data indicates that a particular ATM experiences high usage during lunch hours, it might suggest that placing ATMs near restaurants or food courts could be advantageous. Conversely, low usage data might imply a need to relocate the machine to a more active area.

Demographic Insights

Understanding the demographics of an area can greatly influence ATM placement decisions. Different age groups and income levels exhibit varying financial behaviors. Young adults might favor digital transactions, while older adults may depend more on cash.

By examining demographic insights, you can customize your ATM services to meet the needs of the local population. In high-income areas, for example, ATMs might process larger transaction amounts, whereas in lower-income areas, there might be more frequent, smaller withdrawals.

Combining Data for Success

Combining transaction data with demographic insights provides a comprehensive view of potential ATM locations. This approach allows you to identify areas where ATMs are likely to experience high usage and profitability.

For example, an analysis might reveal that a shopping center frequented by young families and seniors is an ideal spot for an ATM, as both groups might have different but complementary cash needs.

In conclusion, ATM location analysis is a powerful tool for identifying the best locations for your machines. By leveraging transaction data and demographic insights, you can make informed decisions that enhance customer convenience and maximize profitability.

Key Factors for Optimal ATM Placement

When it comes to placing ATMs, several key factors can significantly impact their success. Let's explore these crucial elements:

Foot Traffic

Foot traffic is perhaps the most critical factor in determining an ATM's success. More people passing by means more potential users. Locations like busy shopping centers, busy transit hubs, and vibrant entertainment districts are prime spots. These areas naturally attract crowds, increasing the likelihood of frequent ATM transactions.

Visibility

An ATM that can't be seen is an ATM that won't be used. Visibility ensures that people know where to find your machine. Placing ATMs in well-lit and open areas makes them easy to spot and more inviting to use. A brightly lit ATM not only attracts more users but also improves their sense of safety.

Security

Speaking of safety, security is paramount. Users need to feel secure when accessing their money. Placing ATMs in well-monitored locations, such as near security cameras or in areas with regular foot patrols, helps deter criminal activities. Additionally, advanced security features like anti-skimming devices can further protect users.

Accessibility

Accessibility means more than just being easy to reach. It includes considerations such as being wheelchair-friendly and having intuitive interfaces. Ensuring that your ATM is accessible to everyone, including those with disabilities, widens your potential user base and demonstrates inclusivity.

Financial Behavior

Understanding local financial behavior can guide ATM placement. In areas where cash transactions are prevalent, ATMs will naturally see more use. Conversely, in regions where card payments dominate, the demand might be lower. Analyzing local spending habits and business payment methods can help tailor ATM services to better meet community needs.

By focusing on these key factors—foot traffic, visibility, security, accessibility, and financial behavior—you can strategically place ATMs for optimal performance. Next, we'll explore high-traffic venues that are perfect for ATM placement, ensuring your machines are always buzzing with activity.

High Traffic Venues for ATM Placement

Strategically placing ATMs in high-traffic venues is crucial for maximizing usage and profitability. Let's explore some of the best spots for ATM placement:

Shopping Centers

Shopping centers are prime locations for ATMs. They attract a large number of people daily who often need cash for various purchases. Shoppers appreciate the convenience of withdrawing cash on-site, saving them a trip to the bank. With consistent foot traffic from morning to evening, these venues ensure steady ATM usage.

Public Transport Hubs

Public transport hubs like train stations and bus terminals are busy with commuters every day. These locations are key for ATM placement as commuters often need cash for tickets or snacks. Having an ATM here provides easy access to money when it's needed most, making it a critical service for the on-the-go traveler.

Entertainment Districts

Entertainment districts come alive in the evenings and weekends, drawing crowds to theaters, bars, and clubs. Visitors in these areas might need cash for entry fees or drinks. Placing an ATM in such districts is beneficial, especially during peak times, ensuring visitors have the cash they need for a good time.

Restaurants

Restaurants experience high foot traffic during meal times. Diners often need extra cash for tips or splitting bills. Placing an ATM near popular restaurants can be very effective, catering to diners’ immediate needs without them having to leave the area. This convenience can lead to increased usage.

Gas Stations

Gas stations are another excellent spot for ATMs. Drivers frequently stop here to refuel, and many stations operate 24/7, ensuring constant foot traffic. An ATM at a gas station provides a quick solution for cash needs during travel, especially in areas with few nearby banking facilities.

By focusing on these high-traffic venues—shopping centers, public transport hubs, entertainment districts, restaurants, and gas stations—you can ensure your ATMs are placed where they'll be most effective and used.

Next, we'll look at how enhancing ATM profitability can further boost your bottom line.

Enhancing ATM Profitability

Increasing the profitability of your ATMs requires smart strategies that focus on dynamic surcharging, cross-promotion, and data analysis. Let's break down how each of these can maximize your earnings.

Dynamic Surcharging

Dynamic surcharging is a powerful tool for boosting profits. It involves adjusting ATM fees based on factors like location, time, and transaction volume. For instance, ATMs in busy areas like malls or airports can charge higher fees during peak hours. This strategy ensures that your ATM fees align with demand and market trends.

Regularly reviewing transaction data helps identify the best surcharge rates. This balance between customer satisfaction and revenue generation can significantly improve your bottom line.

Cross-Promotion

Cross-promotion with local businesses can drive more usage to your ATMs. For example, a coffee shop might offer discounts to customers who withdraw cash from an in-store ATM. This partnership benefits both parties: the business gets more foot traffic, and you enjoy increased transaction volumes.

Building strong relationships with business owners is crucial. These partnerships can lead to long-term success and higher profits for your ATM operations.

Data Analysis

Analyzing transaction data is key to maximizing revenue. By examining patterns such as peak usage times and popular withdrawal amounts, you can optimize ATM placement and fee strategies. For example, if an ATM at a grocery store is busiest on weekends, you might market it more aggressively during those times.

Data analysis also helps identify underperforming ATMs. This allows you to make informed decisions about relocating machines to more lucrative spots, ensuring each ATM operates at its full potential.

By implementing these strategies—dynamic surcharging, cross-promotion, and data analysis—you can significantly improve the profitability of your ATM network. Next, we'll explore how to ensure ATM security and maintenance to protect your investment.

Ensuring ATM Security and Maintenance

Protecting your ATMs is crucial for maintaining a profitable and reliable network. Let's explore the essentials of advanced security, regular maintenance, and anti-skimming devices to keep your machines secure and operational.

Advanced Security

Security is a top priority for ATMs. Surveillance cameras should be installed around each machine. These cameras not only deter criminals but also provide evidence if a crime occurs. Additionally, tamper-evident seals can alert operators to unauthorized access attempts, safeguarding your machines from tampering.

Another key security feature is anti-skimming devices. These devices are crucial because skimming is a common fraud tactic where thieves steal card information. Anti-skimming technology helps prevent this by blocking attempts to capture card data, protecting both you and your customers.

Regular Maintenance

Regular maintenance checks are essential to ensure your ATMs remain functional and efficient. Schedule these checks frequently to avoid downtime. An out-of-service ATM can frustrate customers and result in lost revenue.

Maintenance tasks include checking cash levels to ensure machines are stocked to meet demand. It's also important to inspect hardware components like card readers and keypads for wear and tear. Addressing issues promptly can prevent more significant problems down the line.

Staff Training

Training your staff is vital for maintaining ATM security and functionality. Employees should be equipped to handle technical issues quickly, minimizing machine downtime. Collaborating with a security firm can improve response times during incidents, as these firms have specialized knowledge and resources.

By focusing on advanced security, regular maintenance, and anti-skimming devices, you can protect your ATM investments and ensure they operate smoothly. In the next section, we'll tackle some frequently asked questions about ATM location analysis.

Frequently Asked Questions about ATM Location Analysis

What is the best location for an ATM machine?

Finding the perfect spot for an ATM isn't just about sticking it anywhere. It's about choosing places where people are likely to need cash. Bars, restaurants, nail salons, and barber shops are excellent choices. These venues attract a steady stream of customers who might need quick access to cash for tips or small purchases.

Think about it: when you're at a bar enjoying a night out, the last thing you want is to leave the venue to find cash. Having an ATM right there makes life easier for customers and can boost sales for the business.

How can I track my ATM location?

Tracking your ATM's location is simpler than you might think. Every ATM transaction generates an ATM slip number. This number is essential for tracking purposes. If you ever need to verify a transaction or check the machine's activity, this slip number is your go-to reference.

For more detailed information, reaching out to bank customer care can be helpful. They can provide insights into transaction history and resolve any issues related to your ATM location.

What are the criteria for ATM site selection?

Selecting the right site for an ATM involves a few key factors:

Accessibility: Make sure the ATM is easy to reach. This includes considering wheelchair access and ensuring it's in a convenient spot for foot traffic.

Security: Safety is crucial. Choose locations that are well-lit and have good visibility. This not only deters crime but also makes users feel safer when withdrawing cash.

Visibility: An ATM should be in a spot where people can see it easily. If people don't know it's there, they won't use it. High visibility can significantly increase usage rates.

By focusing on these criteria, you can ensure your ATM is well-positioned to attract users and generate profits. Now, let's wrap up with some insights on maximizing cash flow with Merchant Payment Services' ATM management solutions.

Conclusion

Maximizing cash flow and enhancing profits with ATMs is not just about placement—it's about choosing the right partner. At Merchant Payment Services, we specialize in ATM management solutions that simplify ownership and boost your bottom line. With over 35 years of experience, we know the ins and outs of ATM placement and management.

Our solutions are designed to increase foot traffic and sales for your business. By strategically placing ATMs in high-traffic venues like bars, restaurants, and entertainment districts, we help ensure that your machines are where the demand is highest. This not only maximizes cash flow but also increases transaction volumes, leading to higher surcharge revenues.

We partner with leading brands like Nautilus Hyosung and Genmega to provide reliable and efficient machines. Our services also include reducing credit card processing fees, which can further improve your business's profitability. With our expert guidance, your ATMs can become a valuable asset that pays for itself through transaction fees.

Ready to open up the full potential of your ATMs? Learn more about how our solutions can work for you by visiting our ATM management solutions page. Let us help you master ATM placement and maximize your cash flow today!