Choosing the Right ATM Service Provider for Your Needs

ATM service providers play a crucial role in the financial landscape, offering essential services that facilitate cash management, improve customer convenience, and bolster business profitability. For those seeking quick insights, here’s what you need to know:

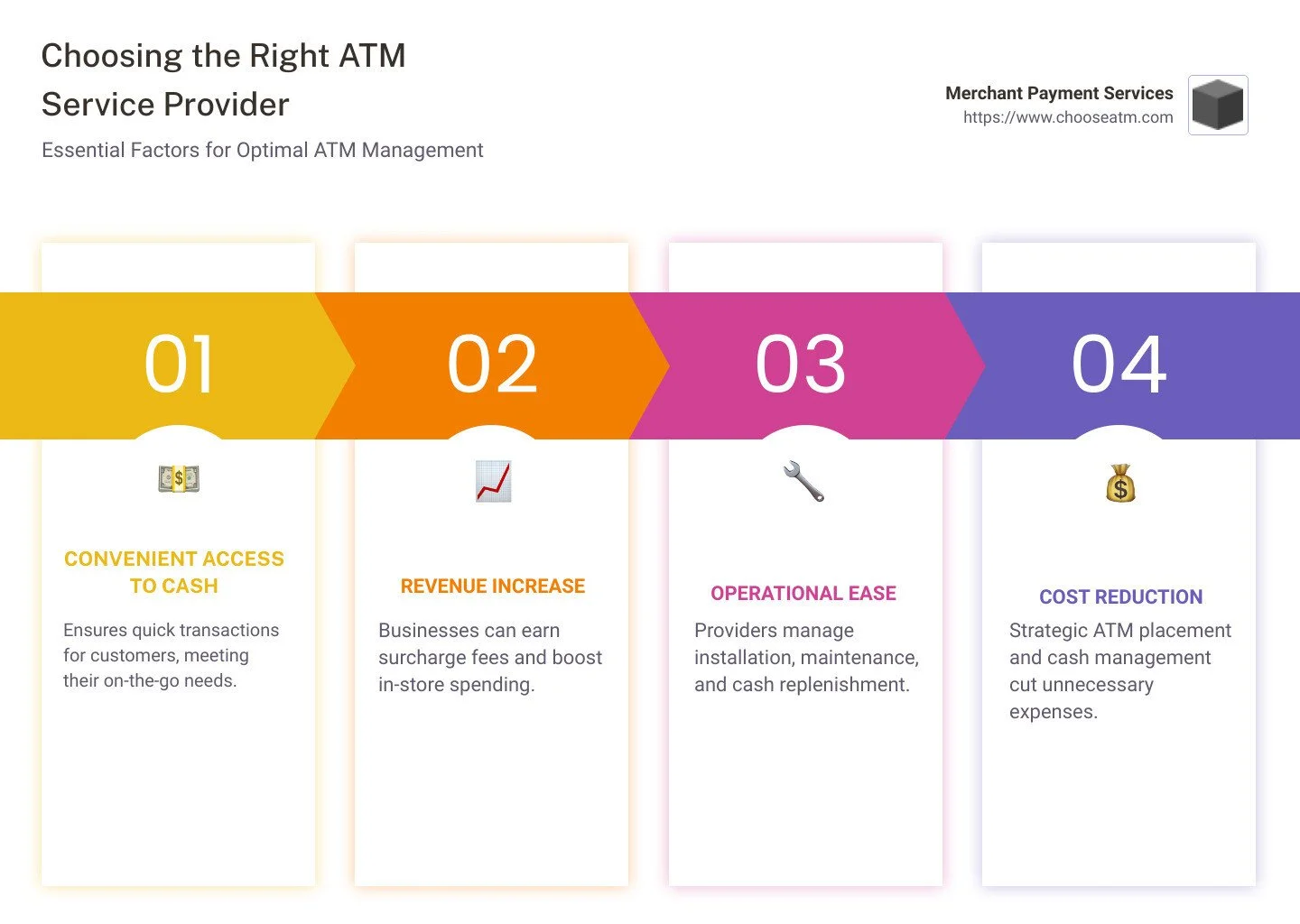

Convenient access to cash: ATMs enable quick transactions for customers, supporting on-the-go needs.

Increase in revenue: Businesses can benefit from surcharge fees and increased in-store spending.

Operational ease: Service providers handle installation, maintenance, and cash replenishment, simplifying ATM management.

Reduced costs: With strategic ATM placement and effective cash management services, providers help cut down unnecessary expenses.

Navigating ATM services can seem complex, but the right provider streamlines operations and adds value to businesses seeking to optimize their financial services. As hubs for quick financial transactions, ATMs bridge the gap between traditional and modern banking needs, ensuring cash is always within reach.

I'm Lydia Valberg, co-owner of Merchant Payment Services. With over 35 years in the industry, I bring a wealth of experience in guiding businesses to choose the right ATM service providers. Let's dig deeper into how these providers can transform your business.

Understanding ATM Service Providers

When it comes to ATM networks, ATM service providers are the backbone that keeps everything running smoothly. These providers manage a wide range of services that ensure ATMs are operational, secure, and efficient.

ATM Networks

ATM networks connect different banks and financial institutions, allowing customers to access their funds from virtually anywhere. These networks are crucial for providing the seamless experience users expect. By linking various machines and financial entities, networks expand the reach of ATM services beyond the confines of a single bank.

Service Providers

ATM service providers offer comprehensive solutions that go beyond just setting up a machine. They handle everything from cash replenishment to technical support. This means they not only fill the machines with cash but also ensure that they are secure and functioning properly.

For instance, some companies specialize in ATM logistics, which includes planning cash transportation schedules to reduce costs and prevent outages. They also offer cash forecasting to optimize the amount of cash in machines, minimizing both shortage and excess.

ATM Logistics

ATM logistics is all about the behind-the-scenes work that keeps ATMs running. This includes the transportation of cash, regular maintenance, and ensuring the security of machines. Effective logistics mean that ATMs can provide uninterrupted service, which is vital for customer satisfaction.

A well-managed logistical operation can significantly cut down costs by avoiding unnecessary trips for cash replenishment and by ensuring that machines are always in working order. This efficiency is crucial for businesses that rely on ATMs to improve customer experience and drive revenue.

In summary, ATM service providers are essential for the smooth operation of ATMs. They manage networks, provide critical services, and handle logistics to ensure that ATMs are always ready to meet customer needs. With the right provider, businesses can enjoy increased revenue, reduced operational hassle, and an overall boost in service quality.

Key Services Offered by ATM Service Providers

Choosing the right ATM service provider can significantly improve the efficiency and reliability of your ATM operations. Here are the key services you should expect from them:

Cash Replenishment

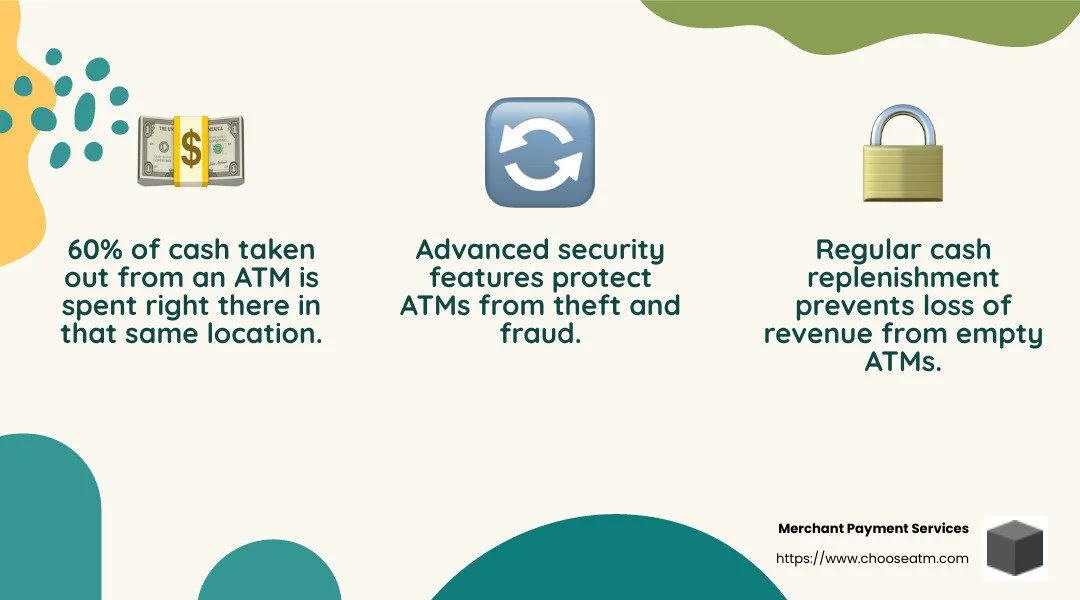

Keeping an ATM stocked with cash is crucial. When an ATM runs out of money, it not only frustrates users but also results in lost revenue for businesses. ATM service providers ensure regular cash replenishment, so your machines are always ready to serve customers.

Providers offer cash forecasting and management services. This helps predict cash needs accurately, reducing the risk of running out while avoiding excess cash that could be sitting idle.

Deposit Processing

Efficient deposit processing is another critical service. Some ATMs allow customers to deposit cash or checks, which means these deposits need to be collected and processed promptly. ATM service providers handle this by coordinating timely pickups and ensuring accurate and speedy processing. This service streamlines operations and keeps your customers satisfied.

Maintenance and Security

ATMs need regular maintenance to function optimally. ATM service providers offer comprehensive maintenance solutions, including both first-line maintenance (FLM) and second-line maintenance (SLM). This ensures that any technical issues are quickly resolved, minimizing downtime.

Security is also a top priority. Providers equip ATMs with advanced security features, such as electronic locks, to protect against theft and fraud. Regular security assessments and updates are part of the package, ensuring that your ATMs remain secure and compliant with industry standards.

By partnering with a reputable ATM service provider, businesses can benefit from seamless cash replenishment, efficient deposit processing, and robust maintenance and security services. These services not only improve the user experience but also contribute to increased revenue and cost savings.

How to Choose the Right ATM Service Provider

When selecting the best ATM service provider for your business, there are a few essential factors to consider that can make all the difference in your operations.

Service Quality

First and foremost, consider the quality of service. A reliable provider ensures your ATMs are always operational. This means regular maintenance, quick repairs, and efficient cash management. Look for providers with a proven track record, like those who offer comprehensive maintenance solutions and have a responsive support team. This way, you minimize downtime and keep customers happy.

Cost Savings

Another critical factor is cost savings. While initial costs are important, consider the long-term savings a provider can offer. For example, some providers offer cash forecasting services, which help you avoid excess cash sitting idle. This can reduce your operational costs over time. Additionally, look for providers who offer competitive pricing on services like cash replenishment and deposit processing. These savings can add up, boosting your bottom line.

Technical Support

Finally, technical support is crucial. ATMs are complex machines that require expert care. Choose a provider that offers 24/7 technical support, so you’re never left in the lurch. Providers who have certified technicians and a quick response time can save you from prolonged outages. This kind of support ensures any issues are swiftly addressed, keeping your ATMs running smoothly.

By focusing on service quality, cost savings, and technical support, you can choose an ATM service provider that aligns with your business needs and helps you achieve your operational goals.

Benefits of Partnering with an ATM Service Provider

Partnering with an ATM service provider offers several advantages that can significantly improve your business operations.

Uptime

One of the most critical benefits is uptime. A reliable ATM service provider ensures your machines are operational around the clock. This means regular maintenance and swift repairs to minimize downtime. With over 60% of cash withdrawn from ATMs being spent in the same location, having your ATM up and running can directly translate to increased sales for your business.

Transaction Processing

Efficient transaction processing is another major benefit. Providers handle the complex logistics of processing transactions, allowing you to focus on your business. They ensure seamless integration with major networks like Visa and MasterCard, so customers can access their funds effortlessly. This not only improves customer satisfaction but also boosts your reputation as a dependable business.

Surcharge Revenue

Lastly, partnering with an ATM service provider can improve your surcharge revenue. Every transaction made at your ATM generates a fee, which can add up to significant revenue over time. In fact, ATMs often pay for themselves with transaction fees. By choosing the right provider, you can maximize this revenue stream, turning your ATM into a profitable asset.

In summary, working with an ATM service provider can help ensure your ATMs are always operational, transactions are processed smoothly, and your business benefits from increased surcharge revenue.

Frequently Asked Questions about ATM Service Providers

What is an ATM service provider?

An ATM service provider is a company that manages and supports the operation of automated teller machines (ATMs). These providers offer a range of services including cash replenishment, maintenance, and transaction processing. They ensure that ATMs function smoothly, providing customers with quick access to cash and other banking services. By handling logistics and technical support, ATM service providers allow businesses to focus on their core operations without worrying about the intricacies of ATM management.

What networks do ATMs use?

ATMs connect to various networks to process transactions. Two of the most popular networks are Allpoint and MoneyPass. These networks enable cardholders to access a wide range of ATMs without incurring additional fees from their bank.

Allpoint is a surcharge-free ATM network with over 55,000 ATMs worldwide. It offers convenience by allowing users to withdraw cash without extra charges at participating ATMs, making it a popular choice for many banks and credit unions.

MoneyPass is another surcharge-free network that provides access to thousands of ATMs across the United States. It is designed to offer cost savings for cardholders, allowing them to perform transactions without additional fees at member ATMs.

These networks are essential for ensuring customers can access their funds conveniently and affordably, no matter where they are. By using ATMs connected to these networks, businesses can improve customer satisfaction and loyalty.

Conclusion

Choosing the right ATM service provider is crucial for businesses looking to optimize cash flow and improve customer experience. At Merchant Payment Services, we specialize in ATM management solutions that not only streamline operations but also maximize your profits. Our 35 years of experience in the industry means we understand the intricacies of ATM operations and are committed to simplifying the process for you.

With access to leading ATM brands and a focus on reducing credit card processing fees, we help businesses increase their surcharge revenue and drive sales. Our services ensure that your ATM is always operational, providing a reliable source of cash for your customers, which in turn boosts foot traffic and sales.

Partnering with an experienced ATM service provider like us means you can focus on your core business activities while we handle the logistics and technical support. Our comprehensive solutions are designed to meet your specific needs, ensuring that your ATM operations are smooth and efficient.

For more information on how our ATM services can benefit your business, visit our service page and find how we can help you achieve cash flow optimization and operational excellence.