Cash Machines: The Secret to Small Business Success

For small business owners looking to boost their cash machine for small business strategy, the initial steps involve optimizing cash flow, enhancing sales, and leveraging ATM management. Unlike traditional setups, modern ATMs offer more than just cash withdrawal services. They significantly increase foot traffic, provide crucial surcharge revenue, and streamline operations.

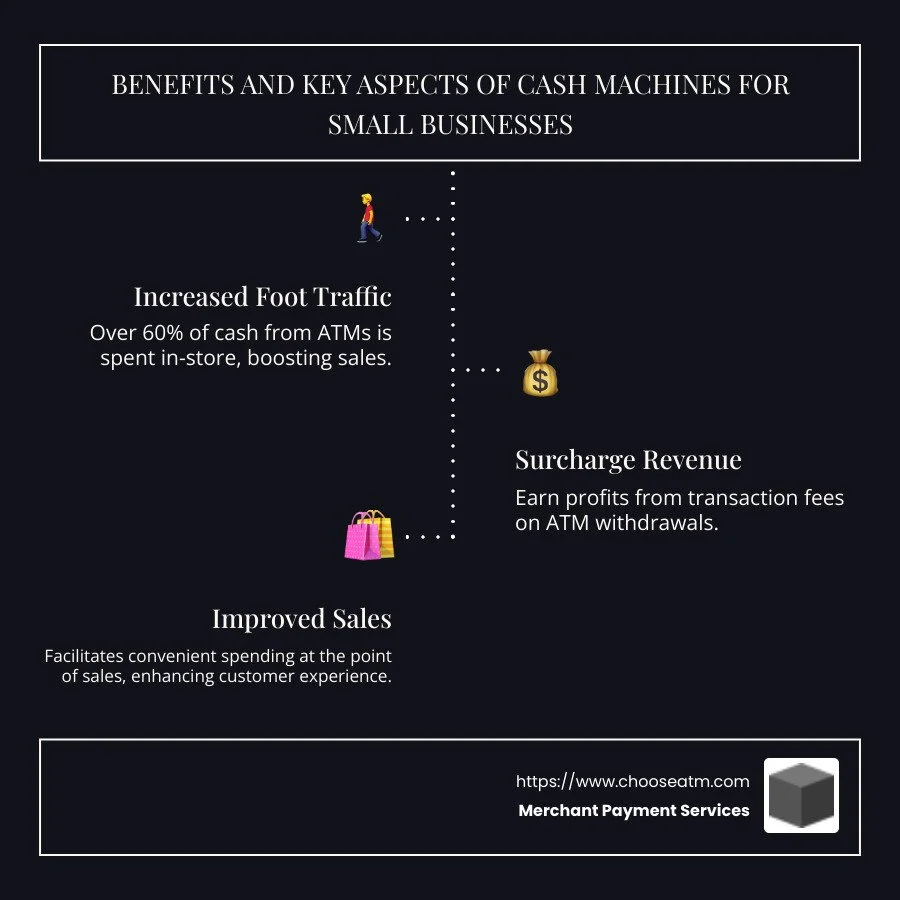

Quick benefits of cash machines for small businesses:

Increased foot traffic: Over 60% of cash from ATMs is spent in-store.

Surcharge revenue: Profits from transaction fees.

Improved sales: Facilitates convenient spending right on location.

Key aspects of successful ATM management:

Choose a reliable partner.

Regularly update your technology.

Prioritize customer ease and seamless transactions.

In the growing landscape of small businesses, cash machines serve not just as a transaction point but as a strategic tool that aligns with business needs of boosting in-store spending and reducing overhead costs. By integrating ATMs strategically, business owners can maintain smooth operations and improve customer convenience, paving the way for increased profitability.

I am Lydia Valberg, and with my extensive background leading Merchant Payment Services, I have experience in optimizing the cash machine for small business model to maximize profits and simplify ATM management for businesses across diverse industries. My expertise ensures that every ATM venture achieves excellence and reliability.

Understanding Cash Machines for Small Businesses

When it comes to managing finances in a small business, understanding the role of cash machines is crucial. These machines aren't just about handling cash; they play a vital role in streamlining operations and boosting efficiency. Let's break down the different types of cash machines that can benefit your business.

Cash Registers

Cash registers are the traditional workhorses of retail. They tally sales, store cash, and print receipts. While they may seem basic, they are essential for small businesses with straightforward needs. However, they lack advanced features like inventory tracking and detailed sales analytics. This makes them less suitable for businesses looking to grow beyond a small size.

Electronic Cash Registers (ECRs)

Electronic Cash Registers are a step up from basic cash registers. They offer some additional features like tax calculations and basic inventory management. However, their capabilities are still limited compared to more modern systems. Many ECRs are becoming obsolete as businesses shift towards more integrated solutions.

Point of Sale (POS) Systems

POS systems are the modern solution for small businesses aiming for efficiency and growth. These systems combine hardware and software to process payments, track inventory, and manage customer relationships. POS systems like Clover Station Duo and Square Register are popular for their versatility and ease of use. They offer features like email receipts, loyalty programs, and detailed sales reports.

Key Advantages of POS Systems:

Inventory Management: Track stock levels in real-time.

Customer Management: Monitor purchase histories and preferences.

Transaction Processing: Handle various payment methods smoothly.

In summary, choosing the right cash machine depends on your business needs. While traditional cash registers may suffice for some, POS systems offer a comprehensive solution that can grow with your business. Understanding these options can help you make an informed decision that aligns with your business goals.

Benefits of Cash Machines

When you're running a small business, having the right cash machine can make all the difference. Whether it's a simple cash register or a sophisticated POS system, these tools help streamline your operations. Let's explore the key benefits they offer, focusing on inventory management, transaction processing, and customer payments.

Inventory Management

A top-notch cash machine can help you keep track of your inventory effortlessly.

Real-Time Updates: Modern POS systems update stock levels immediately after each sale, helping you avoid running out of popular items.

Multichannel Tracking: If you sell both online and in-store, these systems ensure your inventory is synchronized across all sales channels.

This level of management is crucial for preventing stockouts and overstocking, which can tie up your cash flow.

Transaction Processing

Efficient transaction processing is a must for any business, and cash machines are up to the task.

Speed and Accuracy: Whether accepting cash, card, or digital payments, these machines process transactions quickly and accurately.

Seamless Integrations: POS systems often integrate with accounting software, making it easier to keep your financial records up to date.

These features not only save time but also reduce the risk of errors, which can lead to customer dissatisfaction and financial discrepancies.

Customer Payments

Handling customer payments smoothly is essential for a positive shopping experience.

Multiple Payment Options: From cash to contactless payments, a good cash machine accommodates various payment methods, ensuring convenience for your customers.

Customer Engagement: Advanced POS systems allow for personalized experiences, such as offering discounts or loyalty rewards based on purchase history.

This flexibility can help you build customer loyalty and encourage repeat business, which is vital for growth.

In conclusion, the benefits of cash machines for small businesses extend far beyond simple cash handling. They offer comprehensive solutions that improve inventory management, streamline transaction processing, and improve customer payment experiences. By leveraging these advantages, small businesses can operate more efficiently and provide better service, ultimately driving success.

Choosing the Right Cash Machine for Your Business

Selecting the right cash machine for small business is a crucial decision. It affects everything from how you manage sales to how you interact with customers. Let's explore the different options available, focusing on cash management systems, electronic cash registers, and hardware choices.

Cash Management Systems

Cash management systems are more than just cash registers. They are comprehensive tools that help manage various aspects of your business.

Functionality: Cash management systems offer features like inventory tracking, sales analytics, and customer relationship management. This makes them ideal for businesses looking to streamline operations and gain insights into sales trends.

Integration: Many cash management systems integrate with other software, such as accounting or CRM tools. This helps synchronize business data across platforms, reducing manual entry and minimizing errors.

Scalability: As your business grows, a cash management system can scale with you. You can add new features, like online ordering or additional payment methods, as needed.

Electronic Cash Registers

While not as advanced as cash management systems, electronic cash registers (ECRs) still have their place.

Affordability: ECRs are generally more budget-friendly, making them a good choice for businesses with limited cash flow.

Simplicity: For businesses that primarily handle cash transactions, an ECR may be sufficient. They are straightforward to use and require less training for staff.

Basic Features: Some ECRs offer essential features like tax calculations and basic reporting. However, they lack the advanced capabilities of a cash management system.

Hardware Options

Choosing the right hardware is just as important as selecting the software.

Mobile Solutions: Mobile cash management systems allow for transactions anywhere in the store. This can improve customer service, especially in busy retail environments.

Durability: For environments like restaurants, where spills and impacts are common, durable hardware is essential. Look for devices that can withstand daily wear and tear.

Peripheral Devices: Consider what additional devices you might need, such as barcode scanners or receipt printers. Ensure your cash machine can support these peripherals.

When selecting a cash machine for small business, consider your specific needs, budget, and future growth plans. Whether you choose a robust cash management system or a simpler electronic cash register, the right setup will help streamline operations and improve customer experience.

Cash Machine for Small Business: Key Features to Consider

When it comes to choosing a cash machine for small business, there are some key features you should look for to ensure smooth operations and happy customers. Let's explore the essentials: payment processing, inventory tracking, and customer management.

Payment Processing

A good cash machine should make handling payments easy and efficient.

Multiple Payment Methods: Today's customers expect to pay with cash, credit, debit, and even contactless options like Apple Pay or Google Pay. Make sure your system can handle these methods seamlessly.

Integrated Payment Solutions: Look for systems that offer built-in payment processing. This means you can accept card payments right away without needing extra equipment. Plus, you get benefits like PCI compliance and real-time reporting without extra fees.

Transaction Security: Protect your business and your customers by ensuring your cash machine has robust security features. Look for systems that offer fraud prevention measures like PIN or CVV code verification.

Inventory Tracking

Managing inventory can be a headache, but the right cash machine makes it much easier.

Real-Time Updates: With a POS system, you can track inventory levels in real-time. This helps prevent overselling and ensures you always have what customers need.

Multi-Location Management: If you have more than one store, choose a system that supports multi-location inventory tracking. This way, you can manage stock across all your locations from one central system.

Automated Alerts: Some systems can notify you when stock is running low, allowing you to reorder before you run out. This keeps your shelves stocked and your customers satisfied.

Customer Management

Understanding and managing your customers is key to growing your business.

Customer Profiles: Many POS systems allow you to create customer profiles. You can track purchase history, preferences, and contact information, helping you personalize the shopping experience.

Loyalty Programs: Consider a system that supports loyalty programs. These programs can increase customer retention and encourage repeat business by rewarding loyal customers with discounts or points.

CRM Integration: Some systems offer integration with Customer Relationship Management (CRM) tools. This helps you manage customer interactions and build stronger relationships by keeping all customer data in one place.

Choosing the right cash machine for small business involves more than just picking a device to handle transactions. By focusing on features like payment processing, inventory tracking, and customer management, you can streamline operations and improve the overall customer experience.

Frequently Asked Questions about Cash Machines

What is a cash machine for small business?

A cash machine, also known as a cash register, is a device that helps small businesses handle sales transactions efficiently. It does more than just process payments; it also logs transactions and provides valuable sales insights.

Key Features of a Cash Machine:

Payment Processing: A cash machine supports various payment methods, including cash, credit, and debit. This flexibility ensures you meet customer expectations and improve checkout speed.

Transaction Logging: Every sale is logged in the system, providing a detailed record of transactions. This helps with tracking sales trends and generating reports for better business decisions.

Inventory Management: By tracking inventory, a cash machine helps prevent stockouts and overstock situations, keeping your business running smoothly.

Customer Management: Cash machines often include features for managing customer data, such as purchase history and contact information, which can improve customer service and marketing efforts.

Do cash registers do the math for you?

Yes, modern cash registers are designed to handle calculations effortlessly. They automatically calculate the total cost of items, sales tax, and the change due to the customer.

How Cash Registers Handle Calculations:

Automatic Calculations: When items are scanned or entered, the system adds up the prices, applies any discounts, and calculates the total amount due.

Change Due: After the customer pays, the register calculates the change due, reducing the risk of human error during busy times.

Tax Calculations: Most systems automatically apply the correct sales tax based on your location, ensuring compliance with local tax laws.

In summary, modern cash registers simplify the checkout process by handling all necessary calculations. This not only speeds up transactions but also reduces errors, providing a smoother experience for both staff and customers.

Conclusion

In the world of small business, having the right tools can make all the difference. Merchant Payment Services offers a robust solution with their ATM management services, designed to simplify ATM ownership and maximize benefits for businesses.

Why Choose Merchant Payment Services?

Surcharge Revenue: One of the standout benefits of having an ATM on your premises is the potential for surcharge revenue. This is the fee customers pay for using the ATM, which goes directly to your business. It's a simple way to boost profits without extra effort.

Improved Cash Flow: With more cash on hand, businesses can reduce credit card processing fees. This not only improves your cash flow but also decreases dependency on costly card transactions.

Increased Foot Traffic: ATMs are a magnet for foot traffic. When people come to withdraw cash, they often spend it at the location. This can lead to increased sales and new customer opportunities.

Expert Support: With over 35 years of experience, Merchant Payment Services provides unparalleled support and expertise, making ATM management a hassle-free experience for small business owners.

Choosing the right cash machine for small business is crucial for success. Whether it's a traditional cash register, a modern POS system, or an ATM, each has unique benefits. However, the added value of an ATM managed by Merchant Payment Services can provide a significant edge.

To explore how our ATM solutions can benefit your business, visit our ATM management service page and find the advantages of partnering with us.

Boost your business with the right tools and support, and watch your profits grow!