The Art of the Deal: Reducing Credit Card Processing Fees

How to reduce credit card processing fee is a question weighing on the minds of many small business owners. The fees, which range from 1.5% to 3.5% of every transaction, might seem small, but they can significantly affect your bottom line over time. For quick insights into how to reduce credit card processing fee, consider these strategies:

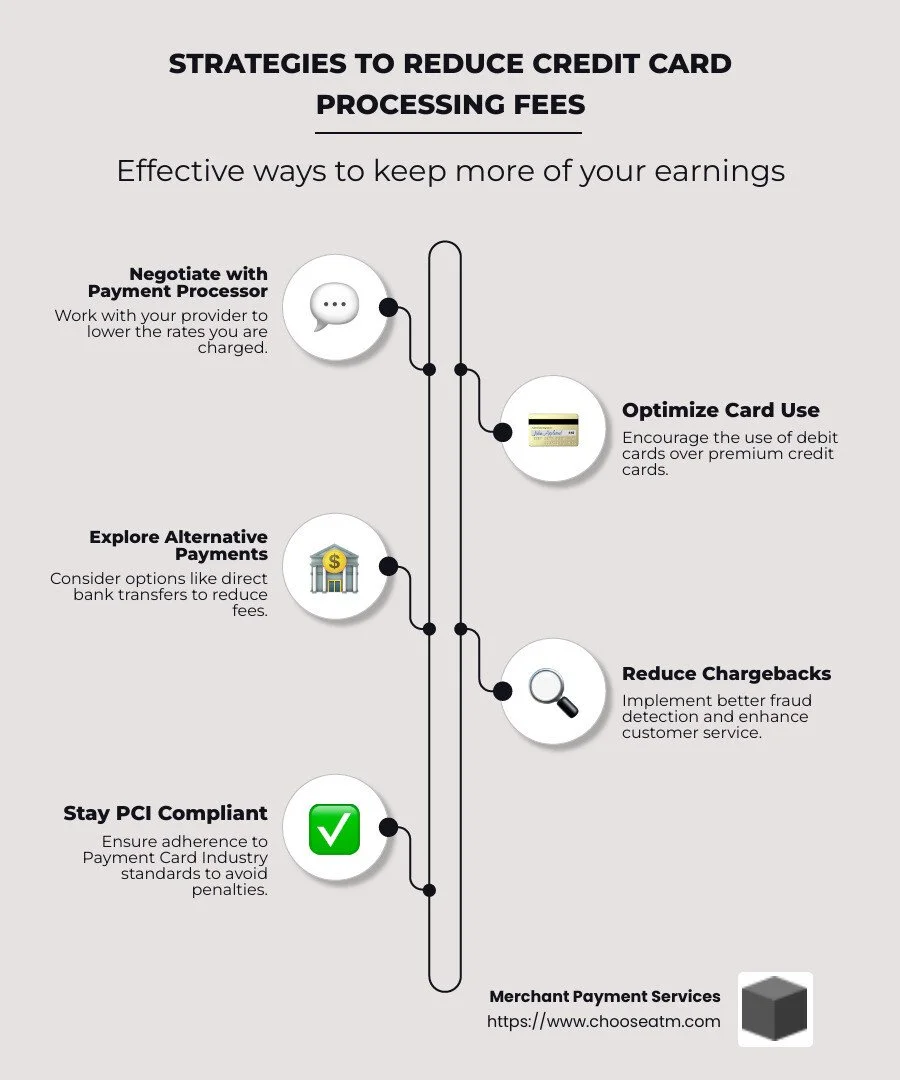

Negotiate with your payment processor to potentially lower rates.

Optimize card use by encouraging cost-effective cards like debit over premium credit cards.

Explore alternative payment methods such as direct bank transfers.

Reduce chargebacks by improving fraud detection and customer service.

Managing credit card processing fees is crucial for any business seeking to maximize profits and minimize unnecessary expenses. As the business landscape evolves, being proactive about these fees can give you a financial edge. Implementing the right strategies can help you keep more of your money.

I'm Lydia Valberg, co-owner at Merchant Payment Services. From decades of experience, I specialize in helping businesses understand how to reduce credit card processing fee challenges. Let's dive deeper into navigating these pressing financial issues and explore practical solutions for your business.

Understanding Credit Card Processing Fees

When you accept credit card payments, you're not just getting paid; you're also paying out. Credit card processing fees can be a bit of a maze, but understanding them is the first step to controlling them. Let's break it down.

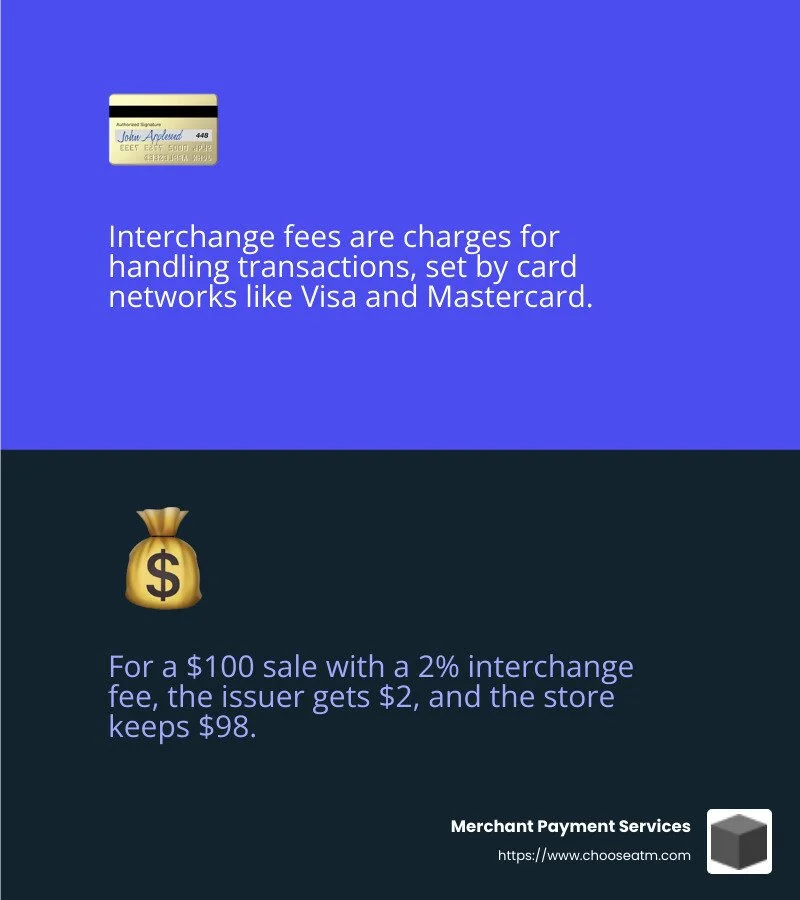

Interchange Fees

Interchange fees are the backbone of credit card processing costs. These charges go to the credit card issuer and are set by card networks like Visa and Mastercard. They cover the risk and cost of handling transactions.

For instance, if you sell a jacket for $100 and the interchange fee is 2%, you'll pay $2 to the issuer. The store keeps $98.

Transaction Fees

Every time you swipe a card or process a payment online, you incur a transaction fee. These fees are usually a fixed amount per transaction and are charged by your payment processor. They cover the cost of processing each card payment, regardless of the transaction amount.

Recurring Fees

Recurring fees are predictable costs that your business pays regularly. These might include monthly account maintenance fees or subscription fees for using a payment gateway. While they can be budgeted for, they still add up over time.

One-off Fees

Unlike recurring fees, one-off fees are unexpected and can pop up at any time. These include things like chargeback fees when a customer disputes a transaction, or setup fees when you first start accepting card payments.

Understanding these fees in detail is crucial. It helps you manage your costs and find ways to lower them. Each fee serves a purpose, but knowing what you're paying for can empower you to negotiate better terms or choose more cost-effective options.

In the next section, we'll explore strategies to lower these fees.

How to Reduce Credit Card Processing Fee

When it comes to cutting down on credit card processing fees, there are several strategies you can employ. Let's explore some effective methods, including surcharge programs, cash discounts, and negotiating fees.

Surcharge Programs

Implementing a surcharge program can be a game-changer for businesses looking to pass on credit card processing costs to their customers. A surcharge is an additional fee added to a transaction paid by credit card. This means that when customers choose to pay with a credit card, they cover the processing cost themselves.

However, it's important to steer this carefully. In some states, like Connecticut and Massachusetts, surcharges are not allowed. You must also notify card networks like Visa and Mastercard at least 30 days before starting a surcharge program. Informing customers both online and at the point of sale is essential for transparency and compliance.

Cash Discounts

Offering cash discounts is another strategy that can help reduce card processing fees. Unlike surcharges, cash discounts involve increasing the listed price of goods or services and offering a discount to customers who pay with cash. This approach incentivizes customers to pay with cash, reducing the volume of credit card transactions and, consequently, the associated fees.

The key here is clear communication. Ensure that your customers understand that the listed price includes the potential for a cash discount, aligning with the Truth in Lending Act's definition of a discount.

Negotiate Fees

Many business owners don't realize that some credit card processing fees are negotiable. While interchange fees set by card networks are non-negotiable, the markup charged by your payment processor often is.

To successfully negotiate, leverage your transaction volume. As Rey Pasinli, executive director at Total-Apps, suggests, "The more you give them, the more negotiating power they have upstream to lower their overhead." In turn, they may lower your rates if your business is valuable to them.

Regularly reviewing your monthly statements can also help identify fees that might be negotiable. Look out for any unexpected charges or increases, and don't hesitate to reach out to your processor for clarification or renegotiation.

By exploring these options, you can take control of your credit card processing fees and improve your bottom line. In the next section, we'll look at additional strategies to lower these costs even further.

Strategies to Lower Credit Card Processing Fees

Reducing credit card processing fees is crucial for any business looking to improve its bottom line. Here are some actionable strategies to help you cut those costs:

Buy Terminals

Leasing payment terminals might seem like a good idea at first. You spread the cost over time, but it often turns out to be more expensive in the long run. Many processors tack on extra fees for leased devices, and switching processors means starting over with new equipment.

Instead, consider buying your terminals. Owning your hardware not only saves money over time but also gives you flexibility. Opt for a protection plan to cover wear and tear or accidents. As a small business with high foot traffic, if your terminal gets knocked to the floor, you can get a replacement for just a few dollars a month.

Stay PCI Compliant

Being PCI compliant is non-negotiable. Compliance with Payment Card Industry Data Security Standards (PCI DSS) ensures that customer card information is securely stored, reducing the risk of costly data breaches and fraud.

Non-compliance can lead to hefty fines and fees. While most processors assist in maintaining compliance, some might sneak in PCI compliance fees. Keep an eye on your statements to avoid unnecessary charges.

Find the Best Merchant Services

Choosing the right credit card processor can make a big difference in your processing fees. It's not just about the per-swipe fee but the entire payment structure.

Tiered Pricing: Some processors categorize transactions into qualified, mid-qualified, and non-qualified. This structure is often arbitrary and lacks transparency.

Interchange-Plus Pricing: This model separates interchange rates from the processor's markup, offering more transparency. You see exactly what you're paying for.

Flat-Rate Pricing: Easy to understand but often more expensive, as it bundles interchange rates with the processor's markup into one flat fee.

To find the best fit, analyze your transaction patterns. If you have high transaction volumes, interchange-plus may be more economical. Don't hesitate to negotiate with your provider or switch to a model that better suits your business needs.

By implementing these strategies, you can significantly reduce your credit card processing fees and keep more of your hard-earned money. Next, we'll explore how to implement surcharge and cash discount programs effectively.

Implementing Surcharge and Cash Discount Programs

When you're looking at how to reduce credit card processing fees, implementing surcharge and cash discount programs can be effective strategies. Both have their benefits, but they come with rules and potential impacts on customers.

Surcharge Compliance

A surcharge program allows you to pass credit card processing fees to customers, but there are strict rules to follow. You can’t add surcharges to debit or prepaid card transactions, and certain places like Connecticut, Massachusetts, and Puerto Rico don't allow surcharges at all.

Before starting a surcharge program, you must notify card networks (e.g., Visa, Mastercard) at least 30 days in advance. Inform your customers at every point of sale, whether online or in-store, and make sure the surcharge is clearly displayed on receipts. Non-compliance can lead to fines, so it's crucial to get it right.

Cash Discount Benefits

Cash discounts are different. Here, you increase your prices and offer a discount to customers who pay with cash. This method rewards cash payments and can reduce your card processing transaction volume.

The benefits of cash discounts include potentially higher cash payments and reduced fees, as you’re not processing as many card transactions. However, communicate clearly with customers. The posted price should be the credit card price, and the discount is applied at checkout for cash payments.

Customer Impact

Both programs can affect how customers view your business. While some might appreciate the option to save money by paying with cash, others could be put off by surcharges or higher posted prices.

It's important to weigh the pros and cons. Consider running surveys or gathering feedback to understand your customer base better. A well-informed decision can help maintain a positive customer experience while managing your processing fees effectively.

Implementing these programs requires careful planning and communication, but they can be powerful tools in reducing your credit card processing fees. Next, we'll dive into frequently asked questions about reducing these fees for even more insights.

Frequently Asked Questions about Reducing Credit Card Processing Fees

How can I avoid card processing fees?

Avoiding card processing fees entirely isn't usually possible, but you can minimize them. One way is by encouraging customers to use alternative payment methods like cash or debit cards, which often incur lower fees. Implementing surcharge or cash discount programs can also offset some costs. Additionally, regularly reviewing your merchant agreement can help identify any unnecessary fees you might be paying.

Can I negotiate processing fees?

Yes, negotiating processing fees is possible. While some fees are set by card networks like Visa and Mastercard and are non-negotiable, the markup fees charged by your payment processor often are. You can negotiate these fees, especially if your business processes a high volume of transactions. To strengthen your negotiating position, ensure you have a good processing history with low chargebacks and compliance with payment standards.

What are the average credit card processing fees?

Credit card processing fees can vary, but here’s a general idea of what you might expect:

Visa: 1.43% – 2.4%

Mastercard: 1.55% – 2.6%

American Express: 2.5% – 3.5%

Find: 1.56% – 3.5%

These percentages reflect the fees for different transaction types, with swiped card payments typically on the lower end and keyed-in transactions on the higher end due to increased fraud risk. Understanding these averages can help you identify if you're paying more than necessary and provide a basis for negotiating better terms with your processor.

Next, we'll explore strategies to lower credit card processing fees, including how to choose the best merchant services and ensure PCI compliance.

Conclusion

In today's business environment, managing costs is crucial, and credit card processing fees can significantly impact your bottom line. Merchant Payment Services is here to help you maximize profits by reducing these fees and enhancing your overall financial strategy.

Our expertise in ATM management and payment solutions means we know how to simplify the complex world of credit card processing. With over 35 years of experience, we've helped countless businesses streamline their payment operations, ensuring that every transaction is as cost-effective as possible. By offering access to top ATM brands and implementing effective surcharge revenue strategies, we empower businesses to thrive financially.

Simplifying management is at the heart of what we do. We understand that running a business is demanding, and dealing with the intricacies of credit card processing shouldn't add to your stress. Our solutions are designed to be user-friendly and efficient, allowing you to focus on what you do best—serving your customers and growing your business.

If you're ready to take control of your credit card processing fees and boost your profits, explore our services at Merchant Payment Services. Let us help you steer the complexities of payment processing with ease and confidence.

The art of the deal isn't just about negotiating fees—it's about making smart, informed decisions that benefit your business in the long run.